Are you a crypto enthusiast looking to invest in the next big cryptocurrency ICO?

Step right this way.

Cryptocurrency ICOs have become a common thing in the crypto industry. However, reports have revealed that about 81% of cryptocurrency ICOs turn out to be scams.

So, if you’re looking to spot the remaining genuine cryptocurrency ICOs that have gone on to give investors immense value, there are some things you need to look out for.

In this article, you’ll discover what to look at when reviewing a cryptocurrency ICO.

But first:

What is a ICO in Cryptocurrency?

An ICO is an acronym for Initial Coin Offering. It represents a fundraising approach that’s almost equivalent to an IPO for cryptocurrency projects.

ICOs are used to pull resources together from members of the public and institutional investors in order to build specific blockchain apps or cryptocurrency services. It involves exchanging certain tokens for other cryptocurrencies or fiat currencies.

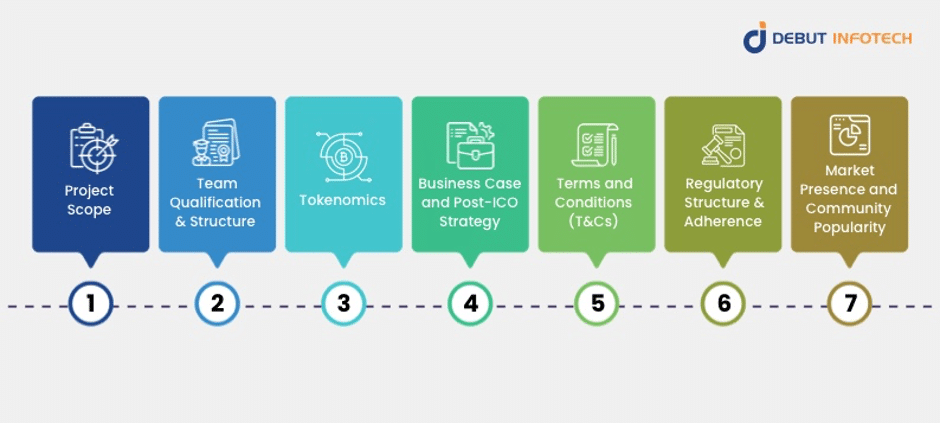

7 Vital Things to Look for When Reviewing Cryptocurrency ICOs

Wondering what to look for when reviewing a cryptocurrency ICO?

The following are 7 essential ones.

1. Project Scope

Investors put their hard-earned money in cryptocurrency ICOs to support cutting-edge technology projects and potentially earn high profits. While nothing is promised due to the dynamic nature of the crypto industry, having a clear and detailed project scope can improve the chances of success. That’s why it is important to carefully understand the scope of a cryptocurrency ICO when examining it.

But what does this mean?

The project scope refers to the exact goals, deadlines, and deliverables of the cryptocurrency ICO. More specifically, it describes the particular problems, proposed solutions, and technical specifications of the tokens to be issued. It’s like a business plan that contains all the essential details regarding its vision and revenue model — a clear action plan.

This project scope is usually detailed in the ICO’s whitepaper. And whether you’re a business issuing tokens or an investor looking to invest in an ICO, this is something that deserves your unwavering attention. It is one of the first things you must look at when reviewing the crypto ICO.

2. Team Qualification and Structure

If you’re satisfied with the action plan laid out in the whitepaper, you then need to be sure that the people executing that action plan are competent and experienced enough to pull it off. Multiple reports reveal that a whopping 81% of cryptocurrency ICOs turn out to be scams. So, if you’re going to be dipping your foot in the murky waters of crypto ICOs, you need to be sure of what you’re getting into and who you’re dealing with.

Run comprehensive background checks on the team members listed on the ICO’s official pages. Do they have a positive track record in the banking industry, blockchain ecosystem, or associated domains? You can find relevant information on LinkedIn and other social media platforms, as well as reputable crypto communities. Some scammers have mastered the art of creating fake profiles across these channels, so go a step further to seek more personal information for trusted, reputable figures in the crypto ecosystem. This information tells you so much about their reputation and whether they have anything to lose if the project fails.

In the same vein, blockchain startups need to ensure they assemble a team of reputable crypto experts with a positive track record. Better yet, you can leave it to an ICO development company to help you assemble the right team and structure their profiles as you launch your ICO.

3. Tokenomics

Tokenomics talks about the overall economics of the cryptocurrency ICO, especially as it relates to the token’s supply and demand characteristics. You can find details about a cryptocurrency ICO’s tokenomics in its whitepaper. These details revolve around important factors like market capitalization, supply, inflation, deflation, utility, and how tokens will be distributed. All these factors influence a cryptocurrency ICO’s tokenomics structure and, consequently, its market price and how that price will appreciate over time.

When reviewing an ICO’s tokenomics, you need to pay attention to the token’s total supply. Does it have a maximum fixed supply or an unlimited supply? Depending on other factors, this detail determines the token’s inflation tendencies.

Additionally, you need to take a look at its market capitalization, which is calculated by multiplying the token’s unit price by its total circulating supply.

Furthermore, it is also helpful to know if the tokens being issued have a specific use case in the blockchain ecosystem. This is one of the major pointers in determining a token’s potential value in the future. All these factors give you a comprehensive idea of the likely conditions your investment will face in the future.

Likewise, token issuers must also structure their token’s tokenomics in a way that gives potential investors enough opportunity for appreciation in the future.

Related Article: How to Launch an ICO – A Complete Roadmap

4. Business Case and Post-ICO Strategy

The business case is closely related to tokenomics in the sense that it examines the token’s real-life business strategy. Apart from just owning tokens due to FOMO, you need to find out if there is any tangible use case for the cryptocurrency that can be implemented in the real-world.

For example, some tokens are used to pay for gas fees on the blockchain system, while others serve specific functions relating to the business. These kinds of tokens with specific use cases on the blockchain ecosystem carry some intrinsic value different from the one driven by general demand. As a result, they tend to have higher value and an even higher potential for appreciation.

In addition to the token’s utility, you also need to look at the company’s post-ICO strategy. This means thinking about its vision for the entire ecosystem after the ICO is over. Furthermore, it encompasses how the company intends to communicate with investors after concluding the token sale. This will tell you whether the company is just looking to cart away with the funds or actually interested in building something valuable.

So, when reviewing a cryptocurrency ICO, you need to think about how the company issuing the token would implement these use cases

5. Terms and Conditions (T&Cs)

Closely related to whitepapers, terms and conditions (T&Cs) are also a very vital, yet, often overlooked part of an ICO. Most people are guilty of just clicking on “I Agree” when signing up without knowing what they’re agreeing to. Don’t be that person!

T&Cs refer to the formal agreement between the token issuer and investors. They dictate the rights and obligations of investors and issuers and other important details about the deal between both parties.

Therefore, paying attention to the provisions and conditions stated in the ICO shows you the legislative protections available. So, a cryptocurrency without a detailed T&Cs document is a major red flag. And for ICOs with one, you need to seek out the counterparty — the selling entity who’s the potential defendant in a litigation against the seller. Most ICOs often install a legal entity as the counterparty as a best practice. So, when you find this, it tells you that you’re dealing with a serious entity with organized and well-structured infrastructures.

Next, you need to look out for the token definition which specifies the rights and obligations associated with the tokens. Other vital details to look out for in the T&Cs document include the terms of token sale, the issuer’s plan for the use of proceeds, and other vital information.

The most important takeaway here is that the terms and conditions contain all the crucial legally-binding details. Study it thoroughly to get authentic details about the cryptocurrency ICO.

6. Regulatory Structure and Adherence

Due to the high percentage of ICOs that have turned out to be scams, regulations and legal statutes guiding ICO launch are always changing and complex. Nonetheless, trustworthy cryptocurrency ICO projects always abide by the prevailing statutes. Potential scams, on the other hand, have a habit of evading these rules and investing in a shiny website instead.

For instance, you need to check if the token issuer is registered with relevant agencies like the SEC. You see, for a business to be registered with the SEC, it means it has undergone a series of several thorough legal checks, and that most likely means you’re in safe hands.

Furthermore, you need to check if the issuer has established Know Your Customer (KYC) and Anti Money Laundering (AML) practices. Fulfilling these legal requirements is the clearest pointer to a cryptocurrency ICO with integrity.

7. Market Presence and Community Popularity

While market presence can also tell you about the authenticity of the cryptocurrency ICO, it is a better indicator of the ICO’s potential to blow up in the crypto ecosystem.

If you notice that a significant amount of crypto enthusiasts are interested and supportive of a crypto project, it might mean that many people have vetted it and decided it is something worth investing in. Nonetheless, you shouldn’t entirely rely on that and Do Your Own Research (DYOR).

Check out social media platforms like Reddit, Discord, and LinkedIn, where there are tight-knit crypto communities, to get inside details about the crypto project. And if you’re a token issuer, invest in marketing campaigns to generate some buzz about your project on these platforms.

Conclusion

Cryptocurrency ICOs create awesome earning and growth potential for both investors and token issuers. And despite the high amount of ICO scams that have been reported, there are still awesome projects out there — you just have to know how to find them.

Start by understanding the project’s scope in terms of the problem it solves and the solution it proposes. Next, vet the team members by checking their track records and reputation. Ensure they have the expertise and experience to pull it off.

The right team often creates projects with scalable tokenomics, a business case, and a post-ICO strategy. More importantly, they adhere to the appropriate regulations and maintain a lively community engagement. However, you should verify all these things before either launching or investing in a cryptocurrency ICO.

Better yet, if all that seems a bit overwhelming, reach out to the blockchain technology experts at Debut Infotech to handle it all. You’re in one decision from your next crypto big break and Debut Infotech can provide just the right guidance!

![What to Look at When Reviewing Cryptocurrency ICOs [7 Vital Factors] What to Look at When Reviewing Cryptocurrency ICOs [7 Vital Factors]](https://www.zshare.net/wp-content/uploads/2025/01/What-to-Look-at-When-Reviewing-Cryptocurrency-ICOs-7-Vital-Factors-1024x576.png)