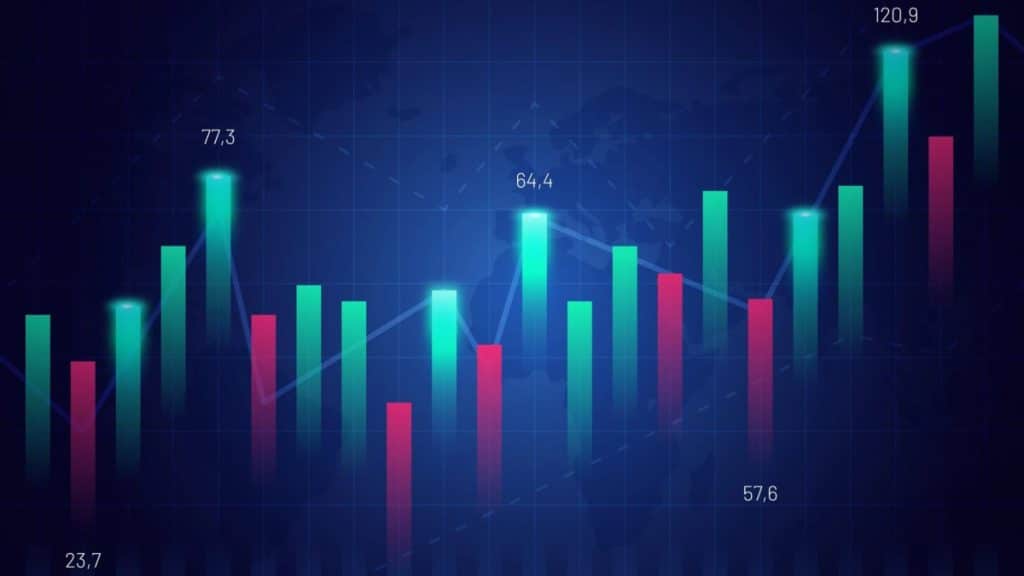

Investing in the stock market can feel like learning a new language. One of the most crucial aspects of this language is understanding candlestick patterns. Whether you’re a newbie or a seasoned trader, candlestick patterns can offer valuable insights into stock market trends. Let’s dive into this topic and make sense of these fascinating tools.

Introduction

Candlestick patterns are like the signposts of the trading world, guiding you through the ups and downs of the market. They provide a visual representation of price movements and help traders make informed decisions. In this blog, we’ll explore what candlestick patterns are, how they work, the various types, and some key patterns that are perfect for beginners. By the end, you’ll have a solid grasp of how to read these patterns and use them to your advantage.

What is a Candlestick Pattern?

At its core, a candlestick pattern is a way to represent the price movement of a security over a specific time period. It’s called a “candlestick” because it looks like one! Each candlestick shows four key pieces of information:

- Open Price: The price at which the security started trading during the period.

- Close Price: The price at which the security finished trading during the period.

- High Price: The highest price reached during the period.

- Low Price: The lowest price reached during the period.

Here’s a simple breakdown:

| Candlestick Component | Description |

| Open Price | The starting price for the period |

| Close Price | The ending price for the period |

| High Price | The peak price reached |

| Low Price | The lowest price hit |

How Does a Candlestick Pattern Work?

Candlestick patterns work by capturing the psychology of market participants. They help in intraday trading to understand the sentiment behind price movements. Here’s a step-by-step look at how they work:

Formation: Each candlestick is formed over a specific time frame (e.g., 1 minute, 1 hour, 1 day).

Shape and Color: The shape and color (traditionally green for bullish and red for bearish) of the candlestick reveal whether the closing price was higher or lower than the opening price.

Patterns: Certain formations of multiple candlesticks can indicate market trends and potential reversals.

Types of Candlestick Patterns

Candlestick patterns can be broadly classified into two categories: single candlestick patterns and multiple candlestick patterns.

Single Candlestick Patterns:

- Doji: Indicates indecision in the market. The open and close prices are very close or identical.

- Hammer: A bullish reversal pattern that forms after a downtrend.

- Shooting Star: A bearish reversal pattern that appears after an uptrend.

Multiple Candlestick Patterns:

- Engulfing Pattern: Consists of two candlesticks. A bullish engulfing pattern indicates a potential uptrend, while a bearish engulfing pattern suggests a downtrend.

- Harami: A two-candlestick pattern where a small candle is contained within the previous larger candle, indicating a potential reversal.

- Morning Star and Evening Star: Three-candlestick patterns that signal potential reversals. The morning star is bullish, and the evening star is bearish.

Here’s a quick reference table for these patterns:

| Pattern | Type | Indicates |

| Doji | Single | Indecision |

| Hammer | Single | Bullish Reversal |

| Shooting Star | Single | Bearish Reversal |

| Engulfing | Multiple | Potential Reversal |

| Harami | Multiple | Potential Reversal |

| Morning Star | Multiple | Bullish Reversal |

| Evening Star | Multiple | Bearish Reversal |

Best Candlestick Patterns for Beginners

If you’re just starting out, here are some of the best candlestick patterns to focus on:

Hammer and Inverted Hammer: Easy to spot and indicate potential reversals after a downtrend.

Bullish and Bearish Engulfing Patterns: These patterns are reliable indicators of trend reversals.

Doji: While it signifies indecision, it’s a great pattern to understand market sentiment.

Things to Consider While Trading Candlestick Patterns

Trading using candlestick patterns isn’t just about recognizing the patterns. Here are a few things to keep in mind:

Context: Always consider the overall market trend. Candlestick patterns are more reliable when they align with the broader trend.

Volume: High trading volume can confirm the validity of a pattern.

Combining with Other Indicators: Use candlestick patterns in conjunction with other technical indicators like moving averages, RSI, or MACD to make more informed decisions.

Practice: Use a demo account to practice identifying and trading candlestick patterns without risking real money.

Patience and Discipline: Wait for the confirmation of the pattern before making a move. Avoid impulsive trading based on incomplete patterns.

Conclusion

Understanding candlestick patterns is a vital skill for anyone looking to trade in the stock market. These patterns provide a window into market psychology, helping you make informed trading decisions. Start by mastering the basics and gradually move on to more complex patterns. With practice and patience, you can use candlestick patterns to navigate the market with greater confidence.

Happy trading! And remember, the key to successful trading is continuous learning and staying updated with market trends. If you have any questions or need further clarification, feel free to drop a comment below.