One of the most dreaded fears for a motorist is being involved in an accident. However, accidents are bound to happen, so long as you’re on the road. The accident may be a minor one where you escape uninjured. It can also be a severe accident where you need to visit the hospital and contact auto insurance online to make a claim.

A car crash can be traumatic and can cause untold losses. At times it can cause disabilities and fatalities. However, you need to call your insurance company to settle your hospital bills when an accident happens. You may also want to have your car repaired or replaced.

And if another car was at fault, seeking reimbursement for your car’s damage should be your priority. One of the significant persons you’ll need is an insurance adjuster when the settlement begins.

Who is an insurance adjuster?

An insurance adjuster is tasked with providing a reasonable claim settlement after an accident. However, insurance adjusters are notorious for offering far less compensation than what a client case is worth. Enter negotiations.

Negotiation skills are critical when dealing with an insurance adjuster. Negotiations can help you get the settlement you deserve for your damages and injuries. How can you obtain fair compensation? This read will help you understand insurance negotiations.

What you should do to get a fair claim settlement

Determine your car’s damages

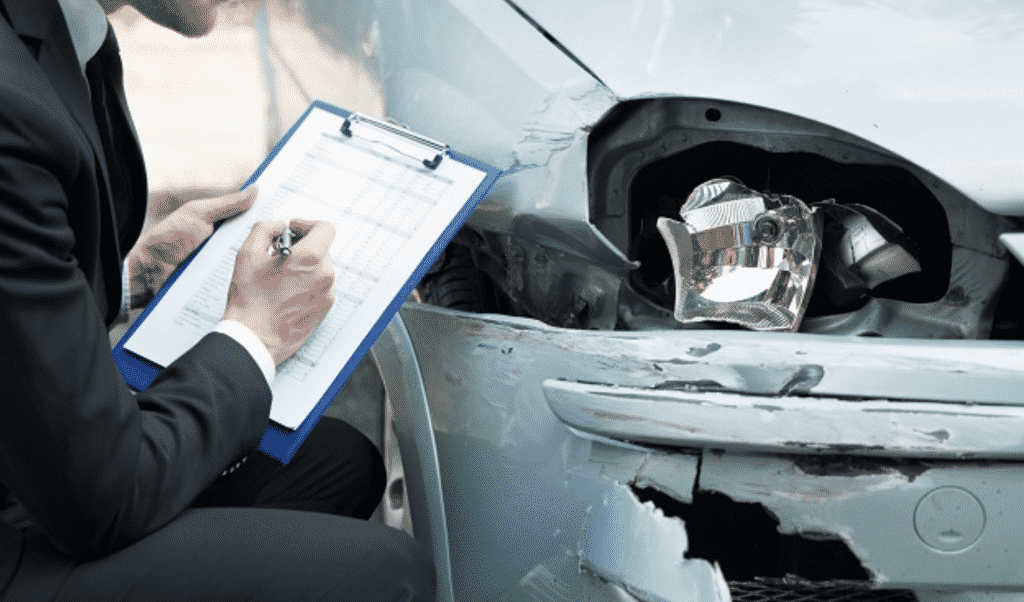

What is your car’s value? Your vehicle’s value can determine whether you deserve a new replacement or repair. When you report the accident to your insurance provider, the company sends someone to access and inspect your car’s status. The insurance adjuster gives a lower estimate than it would cost to repair the vehicle.

After the insurance adjuster devalues your car, you should get a trusted mechanic. The mechanic should inspect your car’s damages in detail and give you a report. The report includes the mechanic’s take about the car’s status. The elements of the report include the labor cost and the spare parts and components required to get the car back on track.

The mechanic’s repair cost is often higher than buying a new car. Therefore, it becomes illogical to repair the wreck at a higher cost than purchasing a new automobile.

Determine your medical expenses

An accident can cause untold suffering to a motorist. Your medical treatment can be manipulated to disadvantage a client and favor the insurance provider. For instance, an insurance adjuster may dismiss some treatment procedures or term them as irrelevant to your injuries.

A patient should be diligent when pursuing medical compensation. Enhance your negotiations ground by keeping a record of all the medical procedures and their charges. Keep receipts for any purchases done during your treatment.

The record should include any expenses incurred due to your injuries, including airtime, local running costs, and others. It should consist of over-the-counter medication, wheelchair, crutches, ambulance services, and anything else you deem necessary.

Talk to your doctor for documentation of expected procedures in the future and include them in the list of your treatment expenses. Ask about physical therapy and counselling sessions and the cost for each.

Negotiate your case

An insurance adjuster is no different from a car salesperson. The insurance adjuster thrives in giving you the least estimate for your claim. On the other hand, your goal is to get the highest estimate for your troubles. Each of the parties strives to outsmart the other party in the negotiations.

How to get a win-win for your settlement

1. Collect all the evidence and documentation you need for your case.

Make copies of all the documentation and make them readily available. The adjuster will strive to set the claim lower than what you deserve. However, do not be anxious and pushy because the adjuster may suspect fraud. Suspicions can set the negotiations on the wrong foot.

2. It is within your right to reject an offer by the adjuster.

You should only accept an offer higher than your expectations or estimates. You’re not the first to reject an initial offer from the adjuster. Therefore, expect the same to happen in your case.

3. Have goodwill during your negotiations.

Let the adjuster know you’re willing to negotiate the offer by slightly lowering your demand. Consequently, the insurance will adjust the offer upwards. The back-and-forth negotiations can take a while before an agreement is reached.

4. Be friendly but firm

The insurance adjuster is human and has feelings and personal interests. Speak honestly and firmly about the troubles and losses you’ve endured since the accident. Your persistence and honesty may appeal to the adjuster’s empathy and influence a higher counter-offer. However, the adjuster’s response is not a valid reason to make you change your worthwhile compensation.

5. Consider hiring a lawyer

Insurance adjusters are notorious for giving clients the short end of the stick. Therefore, they may avoid your calls and meting and postpone negotiation meetings. Such frustrations aim to tire you, so you agree to take the offer on the table.

If you realize that the adjuster is playing delay tactics, it will help involve a car accident attorney to act on your behalf. You can hire an accident claim lawyer if you have sufficient evidence and a strong case. A claim settlement attorney specializes in insurance claims and has the skills to help you.

However, the mention of a legal entity may be enough to make the adjuster settle compensation quickly. An insurance settlement attorney thrives on the odds that winning a client’s case can give them a reasonable percentage of the compensation.

It would also help to talk to an insurance settlement lawyer before accepting an offer. The lawyer can hasten the process and give you legal counsel to potentially give you a handsome settlement.

Conclusion

An insurance adjuster aims to give the lowest estimate. When you want to have the upper hand in settlement claims, collect all the evidence and documentation regarding your case. Sharpen your negotiation skills and hire a lawyer for advice if need be. A well-prepared client should have a fair settlement for their case.