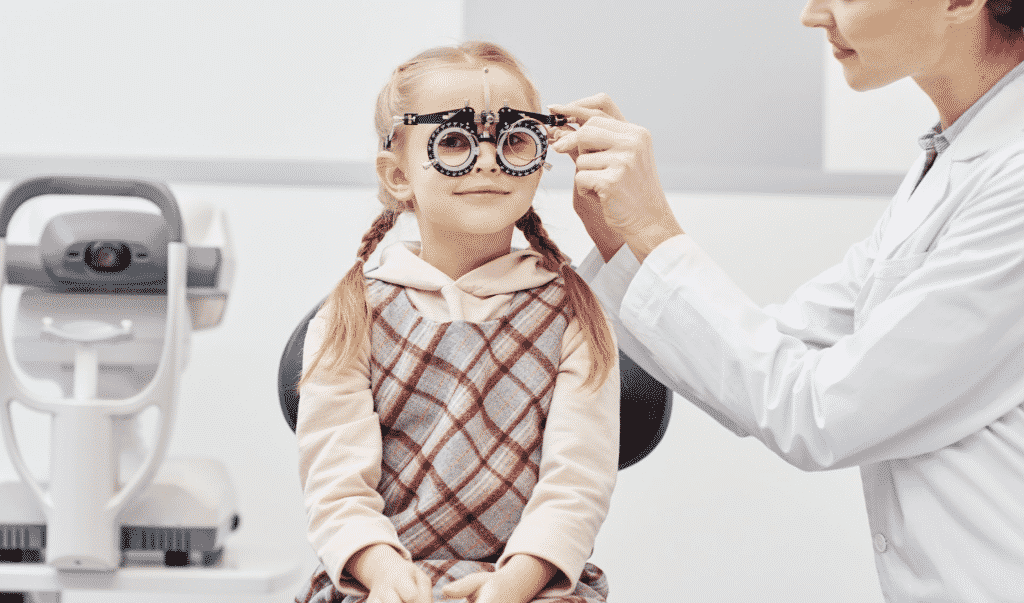

Choosing Insurance for the health of your eyes

Your eyes are an integral part of your health. Ensuring their safety is equally important to enable you to utilize them to their full capacity. If you use contact lenses or eyeglasses, then you know the cost for these is not cheap. For this purpose, you may need to take up an insurance policy or plan for your eye care.

Vision Insurance

Eye insurance is commonly referred to as vision insurance. These are the health and wellness plans designed to reduce costs for routine eye exams/check-ups and prescription eye wears i.e., eyeglasses and contact lenses. An example of an eye care provider for vision insurance is Premier Vision Insurance under United Healthcare Group.

As we delve into vision insurance it is important to understand some eye care professionals that tend to be confusing in terms of their roles.

Key eye care professionals

For starters, we have an optometrist who is an eye doctor and responsible for examining, diagnosing, and treating your eyes. An ophthalmologist performs medical and surgical operations for eye conditions and is a medical doctor. This means an ophthalmologist can provide all the services an optometrist can. An optician who is also mistaken for a medical doctor is a professional who can help fit eyeglass lenses and frames, contact lenses, and other devices to correct a person’s eyesight.

Knowing the roles of these eye care professionals helps to determine where each is needed and required while taking up an insurance cover for your eyes. Some ophthalmologist continues their training to specialize in a particular eye condition or part of the eye. You must consult a suitable eye care professional to get the right eye care needed for your specific eye problem.

Who caters for vision insurance?

Sometimes vision care coverage is catered for by the employer. You may also choose to purchase it as an individual personally. Figuring out the exact details of your vision insurance can be quite a challenge. Depending on the eye care provider you choose you may have several coverage options. Always enquire with your provider about the benefits included and those excluded in your vision coverage. Depending on your health insurance plan most eye exams could be or could not be fully covered. It is advisable to take a health insurance policy that contains separate vision plans. These should provide coverage for eye exams (both medical and routine), contact lenses, or glasses. Added benefits for annual comprehensive eye exams can be a bonus. The Premier Vision Plan is easy to use and helps you save money.

Types of vision insurance and vision care coverage

Under vision insurance, there are generally two types of vision care coverage: vision benefits plan and discount vision plans.

Sometimes it can be confusing to differentiate between vision insurance and health insurance. This is mostly so because many people tend to not understand the benefits offered in one and not the other. Because of this perplexity insurance companies categorize your visits to the eye doctor as routine visits and medical visits. The two visits use the same type of eye doctor either an ophthalmologist or an optometrist.

Generally, the elements in both visits are the same both having a full eye exam. During a routine visit, you get diagnosed with a common eye condition. During a medical exam, you get diagnosed with more complex conditions such as cataracts or conjunctivitis which probably require further medical attention and possibly surgery to correct.

Most health insurances cover eye exams if you have an underlying eye health issue. The co-pay for every medical exam will be determined by your choice of a vision insurance provider and may vary from one provider to another. Most co-pays range from 10 to 40 dollars. Unfortunately, there is often a limitation to coverage by most medical or vision insurance providers. The limit may be on the number of eye exams fully covered yearly or the number of eyewear one can buy. For instance, you can only purchase eyewear once a year or 12months from the last date of service. This means depending on the plan the medical insurance provider may pay part or all the medical exam costs and also give a definitive timeline on how often you can have a covered exam or acquire eyewear. Other times some medical insurances offer a separate “rider” policy to cover routine eye exams.

Conclusion

To answer the question of whether you need eye care insurance, it is a definite yes. The reason for taking up a vision insurance policy is to secure the care for your eyes. Sometimes buying eyewear without medical insurance’s help can be quite expensive. So are the routine eye exams as well as medical exams. Considering a suitable coverage with good benefits and even discounts. A vision plan also helps one save a lot of time trying to figure out how to consolidate the money to pay for an eye problem or illness if diagnosed with one. This can be quite stressful without a vision plan to assist one with the expenses of treatment or any surgical procedures that may be required to be undertaken for your eyesight to be restored or corrected.

It is also important to ensure that we have a variety of medical insurances that offer vision cover to choose from so that we get to weigh the benefits to accommodate our preferences and needs. While comparing vision policies it is of utmost importance to check on the accessibility of the insurance provider, probably one that is in your state. Compare monthly premiums, co-pays, and discounts offered. This helps you get one that is suitable for you, as you keep in mind the cheapest may not always be the best. Also, Understand the insurer’s limits, and last but not least check the insurance company’s ratings to get a better view of what others think of the insurance company you may want to take a policy with.