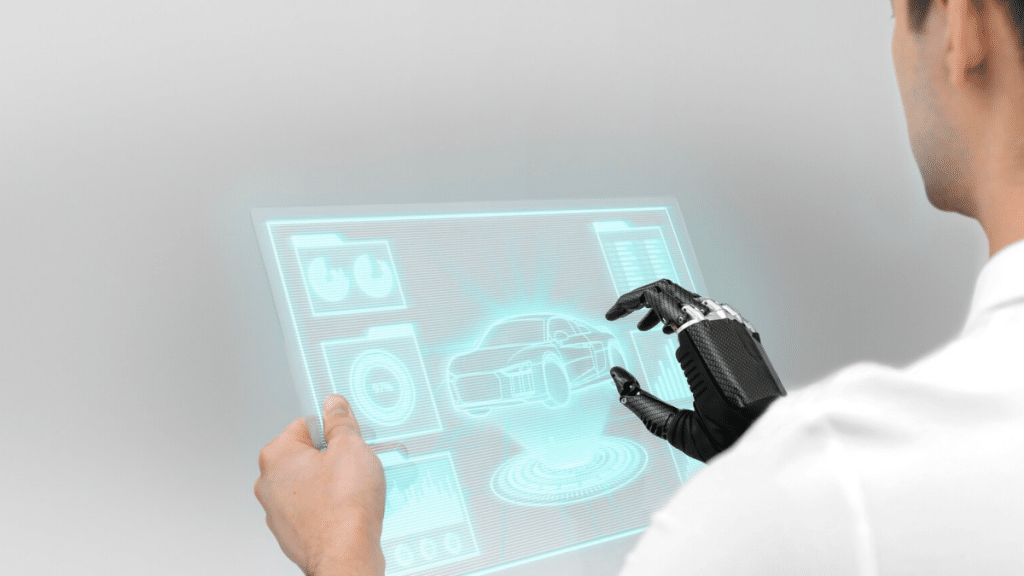

The intersection of artificial intelligence (AI) and the automotive insurance industry is heralding a transformative era in the way risk is assessed and policies are underwritten. This article explores the evolving landscape of auto insurance scoring, delving into the profound impact that AI is poised to have on the future of this critical aspect of the insurance sector.

AI Unleashed:

Artificial Intelligence, with its capacity to analyze vast datasets, identify patterns, and make predictions, is revolutionizing various industries, and auto insurance is no exception. In the context of scoring, AI offers a dynamic and sophisticated approach to evaluating risk factors that goes beyond traditional methods.

Current State of Auto Insurance Scoring:

Traditionally, auto insurance scoring has relied on a set of predetermined factors, such as a driver’s history, credit score, and demographic information. While these factors remain relevant, AI introduces a more nuanced and real-time analysis by considering a broader range of variables. This includes driving behavior data, vehicle telematics, and even external factors like weather conditions, providing a more comprehensive and accurate risk assessment.

Predictive Modeling with AI:

One of the key advantages of AI in auto insurance scoring is its ability to employ predictive modeling. AI algorithms can analyze historical data to identify trends and anticipate future risks. This proactive approach enables insurers to assess and mitigate potential issues before they escalate, ultimately leading to more precise risk predictions and pricing strategies.

Personalized Scoring for Policyholders:

AI-driven scoring allows for a more personalized experience for policyholders. By considering individual driving habits, lifestyle, and other relevant factors, insurers can tailor coverage and pricing to align with each customer’s unique profile. This move towards personalization enhances customer satisfaction and fosters a closer alignment between insurers and their clients.

Challenges and Ethical Considerations:

While the benefits of AI in auto insurance scoring are substantial, there are challenges and ethical considerations to address. Issues related to data privacy, algorithmic transparency, and the potential for bias in AI models require careful attention. Striking the right balance between leveraging AI’s capabilities and maintaining ethical standards is a crucial aspect of navigating this evolving landscape.

The Future Outlook:

Looking forward, the future of auto insurance scoring seems intrinsically tied to advancements in AI. As technology continues to evolve, AI models will become more sophisticated, allowing insurers to refine risk assessments further. Collaborations between insurance companies and tech innovators are likely to increase, paving the way for novel approaches to scoring and risk management.

The integration of artificial intelligence into auto insurance scoring heralds a new era of precision and personalization. As AI algorithms continue to evolve, the industry will witness a shift towards more dynamic, data-driven, and individualized scoring models. Navigating the challenges posed by ethical considerations will be essential, but the potential benefits for insurers and policyholders alike suggest a promising and transformative future for the intersection of AI and auto insurance scoring.